Home loan tax deductions in Japan (as of 2024)

28 Jan 2024 | #money | #japan | #taxJapan has a system that provides income tax deduction for people with a home mortgage in the first years of the mortgage (住宅ローン減税). The rules have changed in the past, and which rules apply depends on when one bought/built their home. In this post I’ll attempt to summarize the rules applicable to a home acquired in 2024. As with all my posts, this is not tax advice and do your own research before making any decision. Also if you find any inaccuracy or mistake, please leave a comment at the end, so that I can correct it.

Overview

One with an eligible mortgage on an eligible home can deduct a percentage of the outstanding loan principal from their income tax. There are multiple limits (maximum income, maximum amount of deduction) and also this can only be done during the first years of the mortgage.

Amount

0.7% of the outstanding principal (used to be 1% before the change in 2020). Source.

Length

13 years for newly built homes and 10 years for existing (used to be 10 years for newly built). Source

Eligible home

There are various requirements that a home has to fulfill to be eligible for this. The major ones are:

- you have to live there

- you have to move in within 6 months of the home being ready

- it has to be at least 50 square meters

- housing loan is for 10 years or more

- you have to have bought it (so no gifting or buying it from a relative)

Full list is here, but you should definitely check with your builder about this.

Please note that there is also an income limit, discussed later in this post.

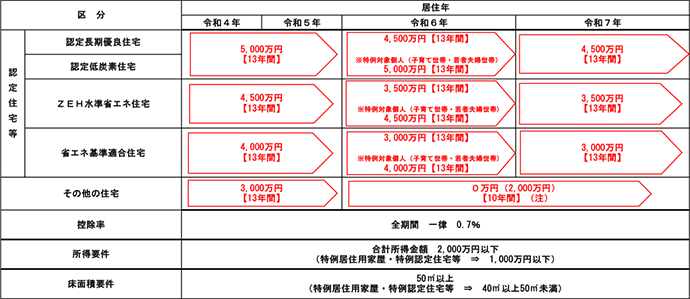

Maximum deduction amount

There is a maximum amount one can deduct (expressed in the maximum of the outstanding principal), and this depends on the quality of the house (whether it meets energy-saving and long-term housing certifications). The limits in 2024 go from 0 to 45 million yen (4,500万円).

Full list from here:

You could look into what each category entails, however it mostly comes down to what your house builder can do. We have talked with a smaller house builder company that said that they don’t have the expertise to apply for any of these certifications, so while (according to them) their quality and insulation is great, you won’t be able to take advantage of this. Meanwhile we found that big house makers handle it easily (often included in their base price), however certain certifications can come with additional restrictions. (Not directly related, but we were told that if we want to apply for the Tokyo Zero Emission House subsidy, all lights have to be low energy, so we can’t use any light we already have, as the maker has to provide information on all lights and they can’t (or don’t want to) deal with our existing lights.)

If the outstanding principal is over the limit, you can still receive deduction but only up to the limit (source).

So overall if the home meets the strictest standards and the outstanding principal is over 45 million yen, then one can get 45,000,000 * 0.7% = 315,000 yen back per year.

Income limit

The income has to be under 20 million yen in a year to take advantage of this deduction, however this is not the full gross income (source):

ロ この特別控除を受ける年分の合計所得金額が、2,000万円以下であること。

The important thing is that this is not 年収 (total gross income) but 所得 (gross income minus necessary expenses). For salaried employees, the only expense that counts here is the salary income deduction (給与所得控除). (Source).

The salary income deduction (給与所得控除) at this income level is 1,950,000 yen (Source), so in effect for salaried employees the gross income limit is 21,950,000 yen.

Income changes around the limit

What if income goes over the limit, then goes under it the next year? You are eligible in the years when your income is under the limit.

この特別控除を受ける年分の合計所得金額が、2,000万円以下であること。

(Source). The income has to be under the limit in the year when the deduction is taken.

なお、所得2000万円の判断は毎年行います。例えば、前年は年収が2200万円で住宅ローン控除を受けられなかった場合であっても、当年の年収が2195万円以下であれば、当年では適用可能です。 The determination of 20 million yen of income will be made every year. For example, even if the previous year’s annual income was 22 million yen and the mortgage deduction was not available, if the current year’s annual income is less than 21.95 million yen, it can be applied in the current year.